Why Mobile Home Investing Is One of Real Estate's Best-Kept Secrets

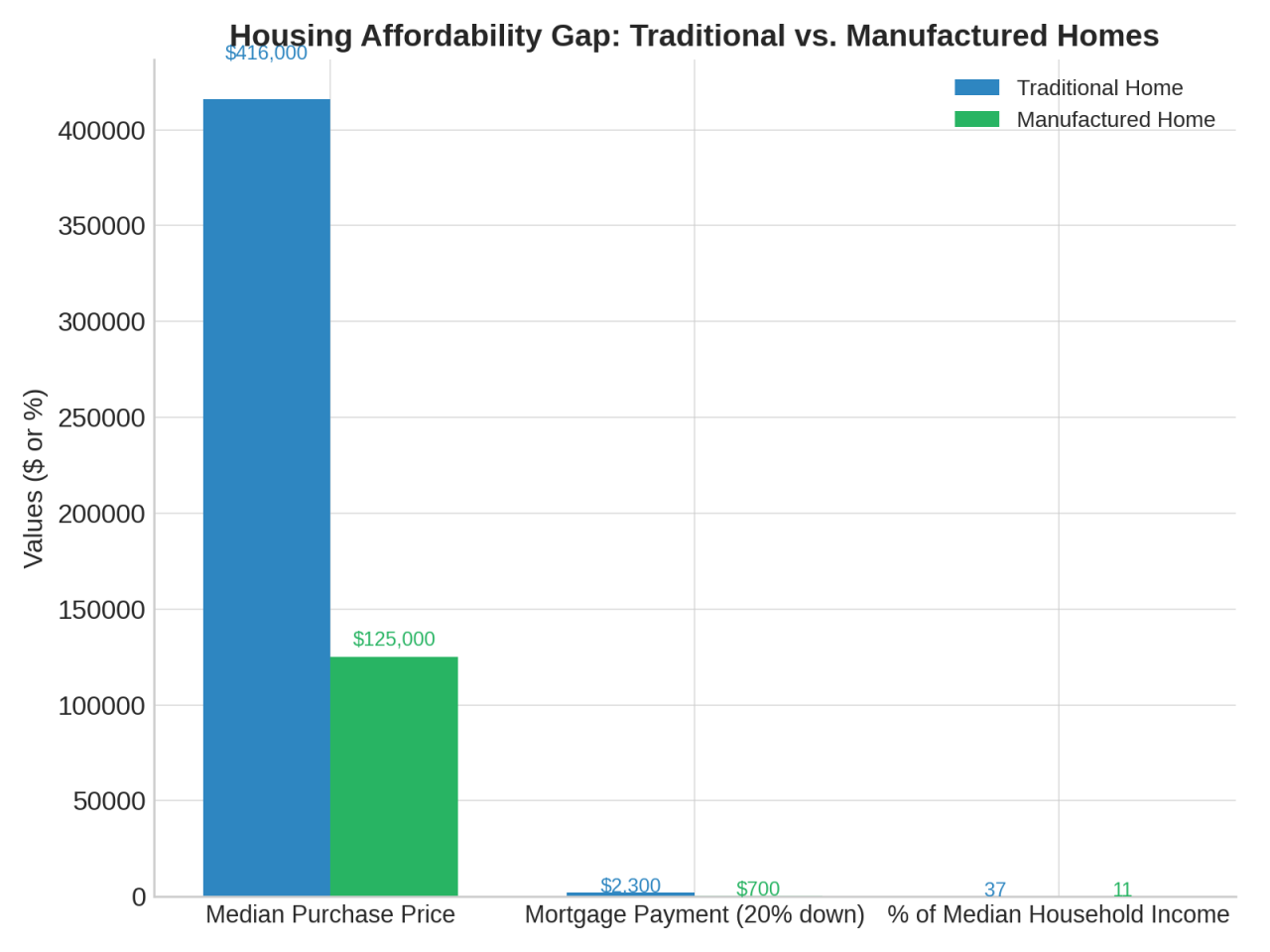

Unlike other crowded corners of the real estate market, the mobile home niche comes with far less competition. Fewer investors pursue these opportunities, which means less bidding pressure and better deals. Even terminology sets this asset class apart. Mobile homes, built before June 15, 1976, and manufactured homes, built after under HUD standards, serve the same market, yet both remain under the radar despite serving millions of Americans. What keeps them attractive is their affordability and strong demand. With new manufactured homes starting at around $75,000, compared to the U.S. median home price of $416,000, entry costs are dramatically lower. And because affordable housing remains scarce, demand is consistently strong.

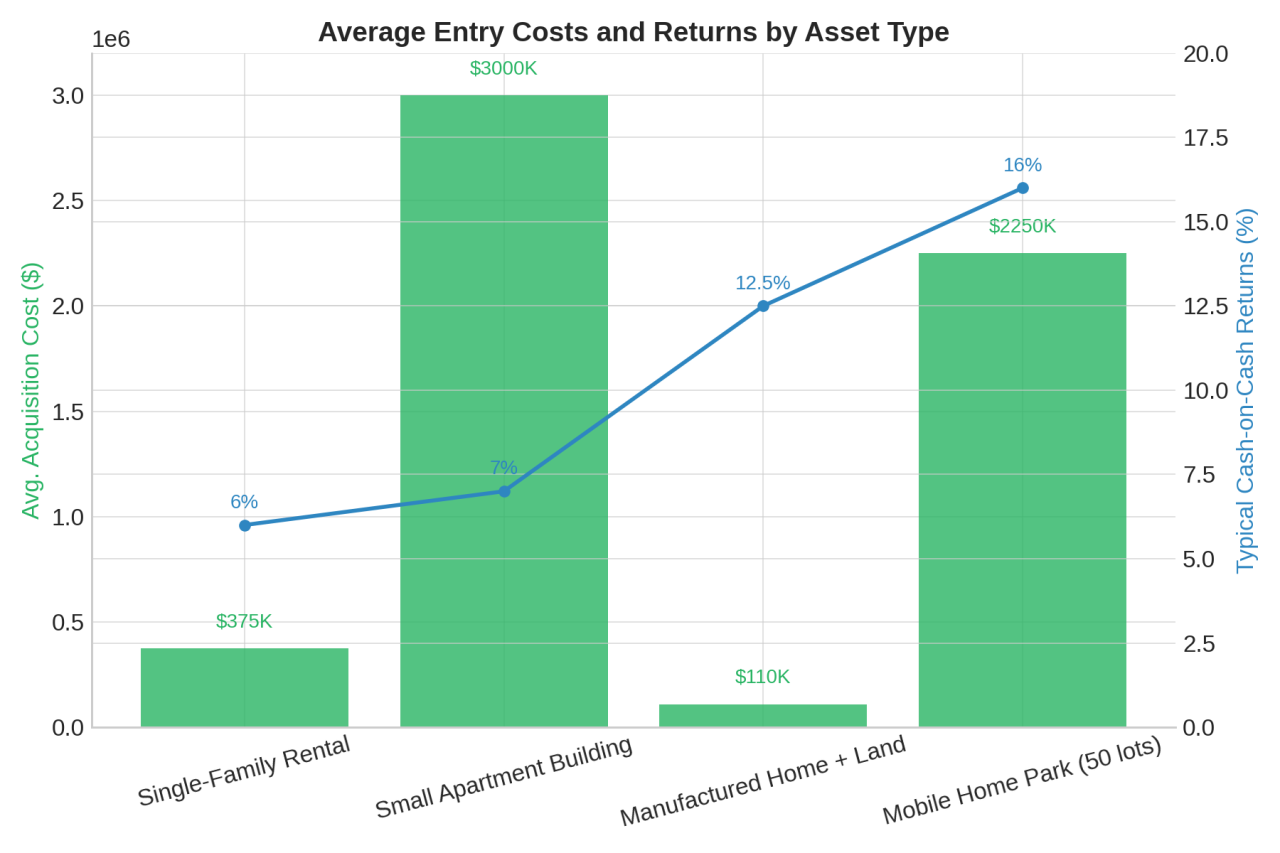

The difference becomes clear when comparing returns. In Phoenix, Arizona, single-family homes average $420,000. An investor buying one rental might earn a 5 to 7 percent cash-on-cash return after expenses. By contrast, manufactured homes with land in surrounding counties can often be acquired for $110,000 to $130,000 all-in, generating returns closer to 10 to 15 percent. For investors, that means more opportunity and less competition.

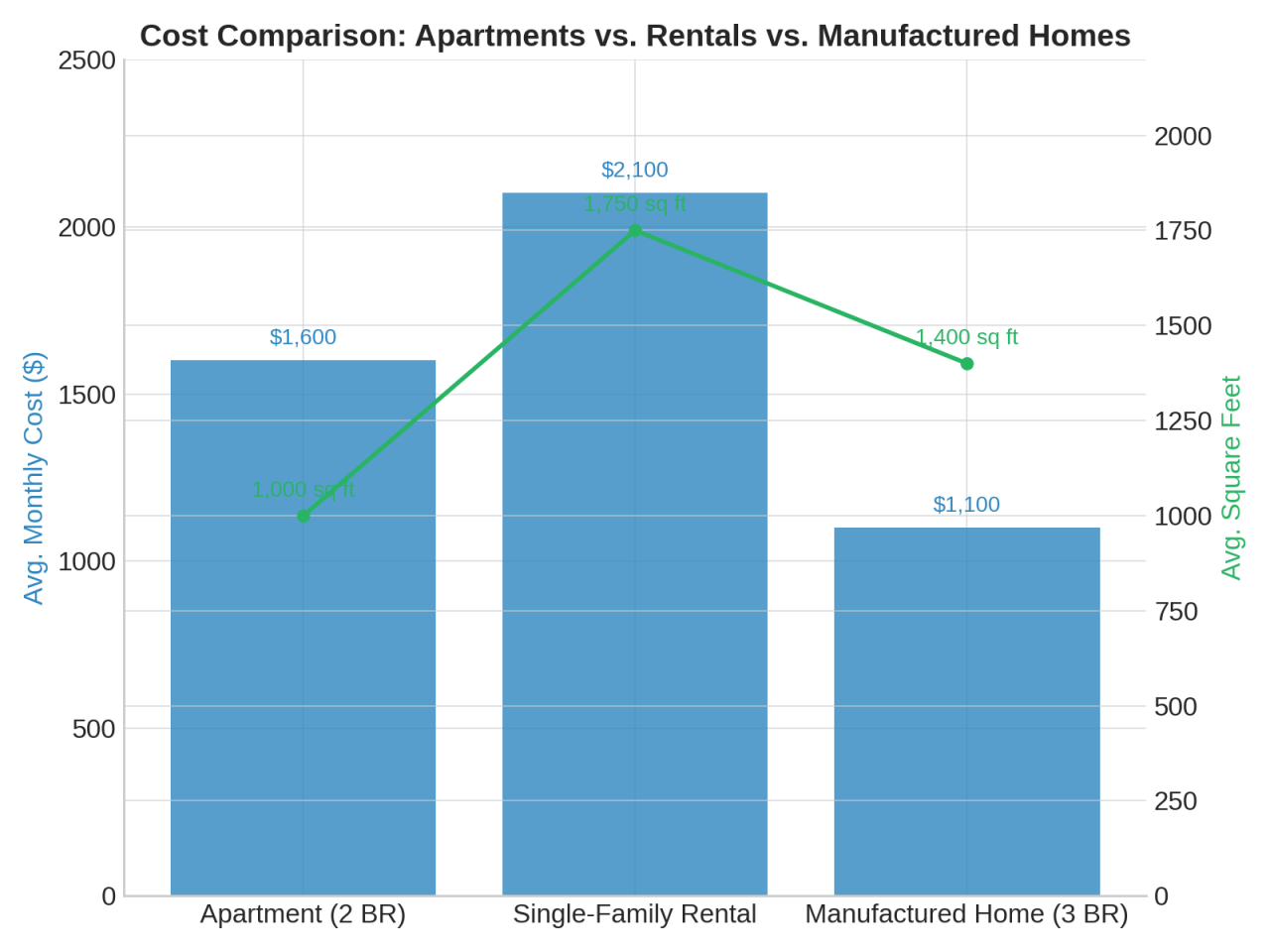

Strong, reliable demand further reinforces the opportunity. In Dallas, Texas, the average apartment rent for a two-bedroom unit exceeds $1,800 per month. A manufactured home on its own land, however, can rent for $1,000 to $1,200 per month and often includes more square footage and a private yard. Families needing more space, retirees stretching retirement dollars, and workers in rural or suburban markets with limited supply all look to manufactured housing as a practical solution. That stability translates into steady cash flow for investors.

Another benefit lies in lower maintenance and operating costs. In most apartment buildings, landlords cover every repair, from plumbing leaks to HVAC replacements. By contrast, many mobile home investors focus on resident-owned homes, where the tenants own the structures and investors own only the land. This shifts the burden of maintenance to the residents, leaving landlords responsible only for infrastructure such as roads, utilities, and landscaping. The difference in costs is substantial. A landlord in Alabama with 20 single-family rentals spends about $36,000 per year on repairs. A mobile home park operator with 40 lots, on the other hand, spends less than $7,000 annually, since residents maintain their own homes.

Lower acquisition costs make the case even stronger. Single-family rentals often require between $300,000 and $450,000 to acquire, while small apartment buildings range from $1 million to $5 million. A manufactured home with land, however, averages between $90,000 and $130,000, while a 50-lot mobile home park can be purchased for $1.5 million to $3 million. Returns reflect that difference, with manufactured homes typically producing 10 to 15 percent cash-on-cash returns and mobile home parks ranging from 12 to 20 percent, compared to the 5 to 8 percent typical in apartments or single-family rentals.

The flexibility of mobile home investing is another unique advantage. Investors can choose to own the home but not the land, placing units in existing parks and renting them out. One investor in Florida bought three homes for $15,000 each, made minor repairs, and rented them for $800 per month each, generating a 25 percent annual return. Others prefer to own both the home and the land, collecting rent on both. An Arkansas couple purchased a home with a half-acre lot for $95,000, renting it at $1,050 per month for a 13 percent return. Some scale larger by buying entire mobile home parks, collecting lot rents from dozens of residents who own their homes. A 60-lot park in Missouri generates about $30,000 per month in rent with only $6,000 in monthly expenses. Others flip older homes, buying them for $5,000 to $10,000, investing $3,000 in repairs, and reselling them for $25,000 to $30,000. Rent-to-own models also provide steady cash flow while reducing maintenance calls, since tenants treat the homes as their own.

All of this comes together in the context of America's affordability crisis. With the median U.S. home price hovering around $416,000 and the median income at $74,500, traditional homeownership remains out of reach for many families. By contrast, a new manufactured home without land averages $125,000. The difference in monthly payments is striking. A traditional home with 20 percent down carries a mortgage of around $2,300 per month, consuming nearly 37 percent of median household income. A manufactured home at $125,000 translates into a payment of about $700 per month, or just 11 percent of income.

Mobile homes bridge the gap between expensive apartments and inaccessible single-family homes, offering families affordability and stability. For investors, this represents not only a financial opportunity but also a chance to play a meaningful role in solving one of the country's most pressing housing challenges.

Mobile home investing may not have the glamour of luxury condos or high-rise offices, but it delivers something far more valuable: steady cash flow, affordability, and scalability. Whether you start small with a single home in a park or scale up to build entire communities, mobile homes offer low barriers to entry, stable tenants, strong returns, and multiple paths to growth. In a housing market strained by affordability challenges, mobile homes aren't just a profitable niche—they're part of the solution. For investors seeking sustainable wealth, this remains one of real estate's best-kept secrets.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.

Comments