3 Reasons Mobile Home Parks Outperform Other Real Estate Assets

At their core, mobile home parks are residential communities where residents own their homes and lease the land beneath them. Park owners provide infrastructure and maintain common areas, while residents are responsible for the upkeep of their homes. Think of it as a land-lease model: instead of vehicles in a parking lot, manufactured homes sit on individual lots connected to utilities. Despite the name, these homes rarely move—the cost and complexity of relocation make it impractical.

This structure creates a rare alignment of interests. Residents enjoy affordable homeownership and long-term stability, while investors benefit from steady income and limited operational headaches. Specifically, mobile home parks offer three advantages that make them uniquely attractive compared to other real estate assets.

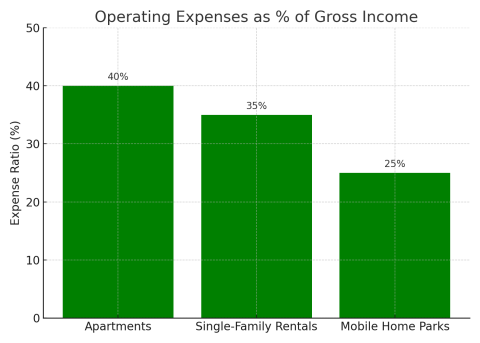

In most rental housing, landlords own both the structure and the land, and therefore shoulder the full burden of maintenance, repairs, and capital improvements. Mobile home parks flip this model. Residents typically own their homes outright and lease only the lot. That distinction makes all the difference. Because residents have equity in their homes, they are naturally motivated to maintain them. Park owners, meanwhile, are responsible only for the land, utilities, and common areas. The result is lower operating expenses, fewer repair calls, and higher profit margins. One telling example comes from Oklahoma City, where a small apartment building with 20 units averages $6,000 annually in repairs and maintenance, while a 50-lot mobile home park in the same metro reports less than $1,500 each year, since residents handle their own roofs, plumbing, and HVAC.

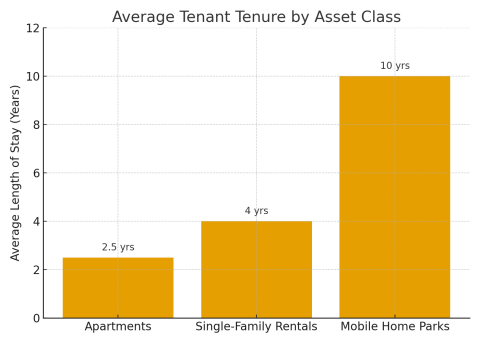

Tenant stability is another defining strength of mobile home parks. On average, residents stay ten times longer than apartment tenants. Affordability plays a major role, as lot rent averages around $500 per month nationally—far less than typical apartment rents, which exceed $1,300 per month in many cities. Ownership also encourages permanence, as residents who own their homes are far less likely to uproot, especially since alternative affordable housing options are scarce. The consequence of nonpayment is also significant. Residents risk losing not just their lot, but also their home, making rent one of their highest priorities. During the COVID-19 pandemic, while many landlords faced widespread delinquencies, mobile home park operators reported near-perfect collection rates. National eviction rates for nonpayment of lot rent remain below one percent, and median resident tenure in mobile home parks is over ten years compared to just two and a half years in multifamily apartments. A 100-lot park in Little Rock, Arkansas, reported an average occupancy rate of 98 percent across 15 years, even through recessions, while nearby B-class apartments fluctuated between 85 and 93 percent depending on market cycles.

Turnover, which is one of the biggest expenses in traditional rental housing, is also far less of a concern in mobile home parks. Vacancies in apartments typically mean cleaning, repairs, marketing, concessions, and lost income. In mobile home parks, turnover is rare—and when it does happen, it carries little cost to the owner. Because moving a manufactured home can cost $5,000 to $10,000 for short distances and up to $20,000 or more for longer relocations, residents almost always sell their homes rather than relocate them. This means the new buyer takes over the lot lease, and income for the park owner continues uninterrupted. One example comes from Georgia, where in a 70-lot park only two residents moved out in a five-year span. Both sold their homes on-site to new buyers, allowing the park owner to avoid vacancy losses and turnover costs entirely. By comparison, an apartment landlord in the same city budgets $1,800 to $2,500 per unit in turnover costs each year.

The numbers tell the story clearly. Apartments typically see residents stay two to three years, with turnover costing between $1,500 and $2,500 per unit. Single-family rentals average three to five years, with turnover costs of $2,000 to $3,500 per home. Mobile home parks, however, average ten years or more with essentially zero turnover costs to owners. On the expense side, apartments typically run at 35 to 45 percent of gross income, single-family rentals at 30 to 40 percent, and mobile home parks at a leaner 20 to 30 percent.

For investors seeking durable cash flow, lower operating burdens, and exceptional tenant stability, mobile home parks stand out as one of the strongest asset classes in real estate. Far from outdated stereotypes, these communities are often well-maintained, close-knit, and—most importantly—provide essential affordable housing to millions of Americans. As the demand for affordability intensifies, the fundamentals behind mobile home park investing remain solid. With residents motivated to stay, costs kept low, and income streams highly reliable, the case for mobile home parks is stronger than ever.

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.

Comments