Bio

Ryan Lopez

So who am I? I am an architect/entrepreneur. I have owned my own business for about 10 years. I have always had an entrepreneurial spirit. As far back as I can remember, my parents owned their own catering company that expanded into the restaurant business. It was very hard work and oftentimes not enough to get us by.

Between my sister's health issues and the fact that I was diagnosed with severe dyslexia that made school very challenging for me, we ended up costing our parents dearly. When I was very young, I needed to be enrolled in a school that specializes in helping kids with learning disabilities, learn to cope with them. This was not cheap and our whole family was affected by that reality. It’s an awful lot to handle as a child, having to go to a “special” school, and realizing that you are largely the cause of your family's financial stress because of it. These were really some of the darkest years of my life.

But with the proper help and counseling, and a lot of hard work, I eventually learned to deal with my disabilities, graduate high school, and move on to college. If you asked anybody that knew me back then, no one would have thought that I’d ever even go to college, much less graduate. But with a lot of hard work and dedication, I not only graduated from university with a Bachelors of Architecture degree, but I even made it on the Dean’s List. Walking in my graduation ceremony and receiving my diploma, was one of my greatest achievements at that time and one of my proudest moments, the feeling that I had conquered this seemingly impossible task and against all odds and expectations.

My story started with architecture. It was either going to be architecture or construction, but I knew from a young age, that's where I wanted to be. Oddly enough, if you had asked any of my friends in high school, they would have told you I would end up being a computer geek.

I remember the moment I decided I was going to be an architect. I was working with an HVAC contractor in the Inglewood School District, wrapping duct with insulation in a 110° attic. I remember coming down to get water and take a rest, and seeing these guys in suits and hard hats carrying rolls of plans under their arms and walking into an air conditioned site trailer. I thought to myself, “yeah I can do that.”

It did seem like a glamorous job, and certainly it must pay very well. But when you're young and excited to be on this new journey, you don't really pay attention to the reality of the situation, even when all your architecture professors are telling you that architecture is the slowest, dumbest way to make money. You practice architecture because you are passionate about it.

Fast forward 20+ years and two recessions later, you realize just how right your professors were about architecture. The fact is, you can almost judge the economy by the architecture profession. Think about it. Due to the expense and length of any construction project, architecture is the first thing to get cut from a budget in a looming economic downturn and it’s the last thing to get added back onto people's budgets on the upswing. Architecture literally has the longest slump of any profession. It’s the first to go down and the last to come back up. So I decided, I wasn't going to let that happen to me a third time. That’s when I decided I was going to get into real estate.

It wasn’t just a knee jerk reaction. I had put a lot of thought into this. I couldn't just forget about the last almost 30 years of my life, My degree in architecture and working for more than 2 decades in the field. I knew I had to do something that could incorporate everything I have learned and all of my experiences, into something related but new and more stable. So I chose real estate development. This is even more of a natural evolution for me since I had the privilege of growing up with the influence of my fathers best friend who is a real estate mogul. Like my very own Rob Kiyosaki “Rich Dad,” I realized that he had influenced me to favor real estate since that is how he made all his millions and I grew up listening to all his stories.

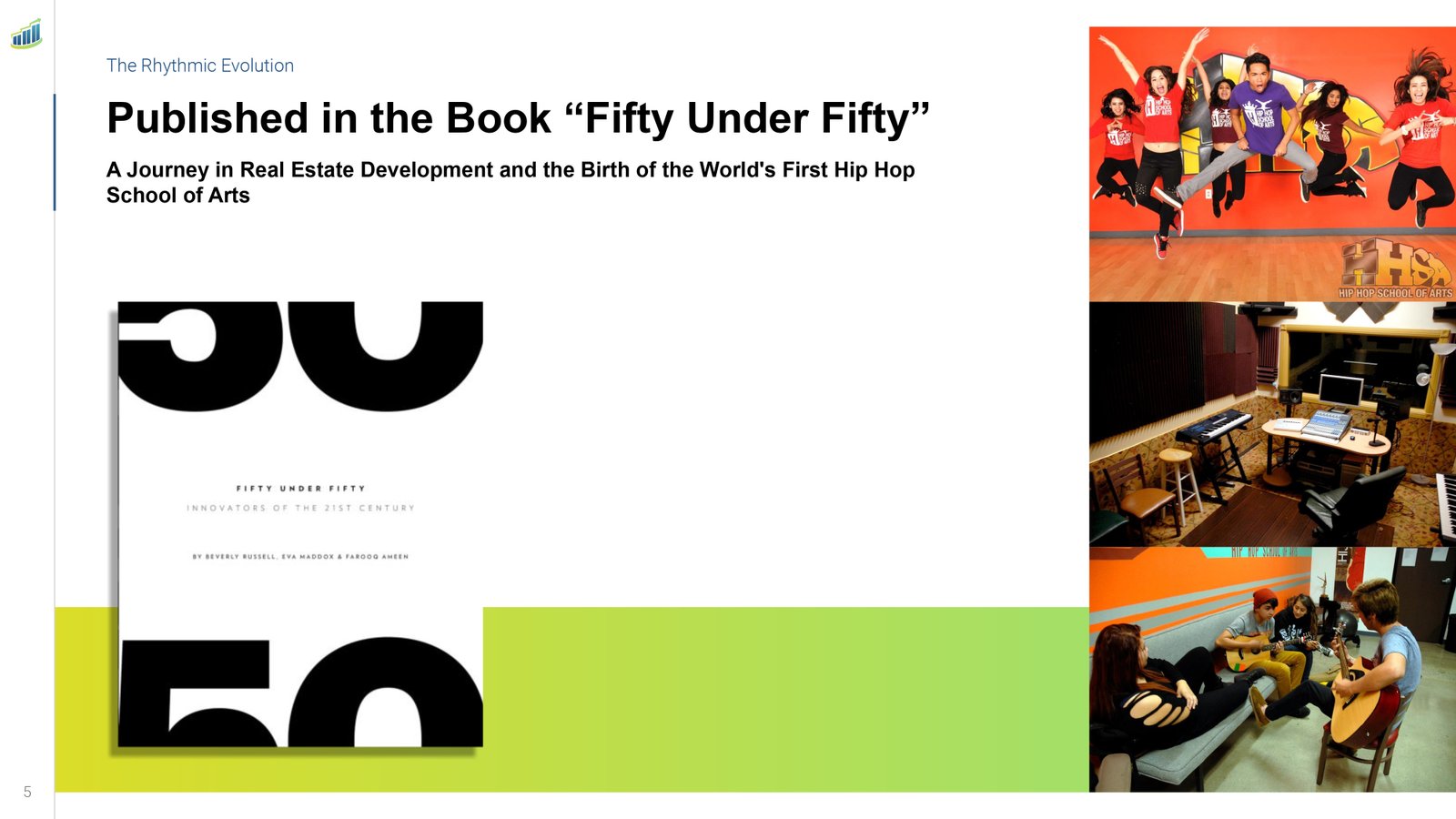

My first role in real estate development came with my design and construction administration on a large scale project for a friend of mine. Lil’ Cesar, a famous hip hop, B-boy from the 80’s had a dream to start the world's first Hip Hop School of Arts. This was a large project, converting an existing bank building into a 14,000 s.f. school, incorporating every facet of hip hop, from dance, to graffiti art and music production. It was a fantastic experience and got me published in a book by renowned architectural writer Beverly Russell, entitled 50 under 50. This experience was the perfect springboard into my own personal developments.

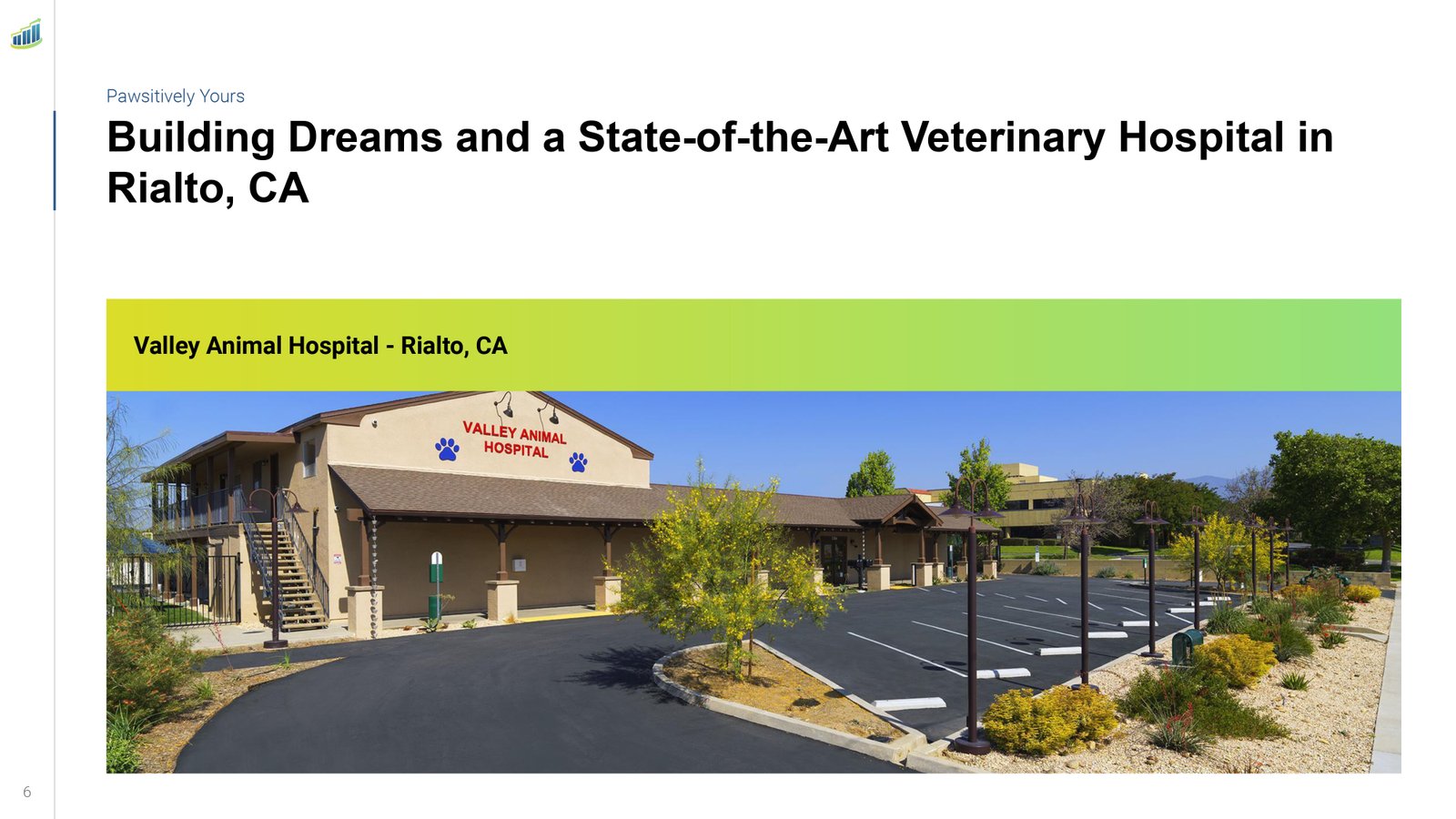

Together with my very significant other, my better half, who is a veterinarian, we bought and built our own veterinary hospital in Rialto, CA. We purchased a 12,000 s.f. building on a 2.23 acre property, brought it down to the studs, and rebuilt it into our very own, state-of-the art, dream hospital, which I designed and managed the construction. The building is divided into a 6,800s.f. Veterinary hospital, a boarding and daycare facility, and a grooming facility, all under one roof. The grooming was technically project number three and the boarding and daycare was project number four.

So with 4 significant and successful development projects under my belt, I decided to expand into real estate investment. Over the last several years I have embarked on a massive real estate investment educational journey, taking several courses and reading an absurd amount of books on the various asset classes and other related topics like tax advantages of real estate and corporate structuring. I have had the distinct pleasure of working with several amazing mentors in real estate like Nate Armstrong and learning from his team of amazing real estate inventors and entrepreneurs. I have learned from masters such as Grant Cardone, Ron LeGrand, Stacy Rosetti, and Rob Kiyosaki. I have also read so much from people like Peter Conti, Hunter Thompson, Pace Morby and so many others.

Throughout my educational journey, there are a number of repeating themes and concepts that keep coming up. One such concept is, all facets of real estate investing are related, and there is a time and a place for every strategy out there, whether that is:

Wholesaling, fix and flip, BRRRR, buy and hold, to different financing options like lease/options, C.D.S., subject to, wraparound mortgage, private money, SLP, JV, and syndication. The concept also conveys to different real estate asset classes.